Fintech – Like the name suggests fintech apps are a blend of finance and technology. It refers to technologies, softwares and apps that empower businesses and individuals to manage banking and finances or generate insights using mobile and desktop devices.

In today’s world, consumers are progressively embracing tools and applications to efficiently manage and execute a wide range of financial activities. These include funds transfer, budget tracking, expense tracking, as well as generating income and expense insights.

Carrying finance activities on banking applications helps customers manage various financial challenges and reach their finance goals.

Contents

Why Do Customers Love Fintech Apps?

Cost-Effective:

Cost effectiveness is the biggest benefit that businesses and individuals get with fintech apps. Fintech app development is designed keeping reusability of the code in mind as various apps can be developed using the same code frameworks.

This significantly reduces time and money facilitating developers to focus on other aspects of application development.

Never miss an update from us. Join 10,000+ marketers and leaders.

Finance app also enables automation of various operations such as automated expense tracking, credit risk management, auto credit score update, faster funds transfer thereby saving time and money for individuals to use.

Faster Access to Banking Services:

Fintech apps enable faster access to banking services. You can carry out most of your banking actions on mobile devices using banking applications.

Financial inclusion and deepening improves customers’ access to banking services which help save money while providing convenience and better experience.

Convenience and Ease-of-Use:

Finance apps are convenient to use which increases the efficiency of the transactions done using mobile devices. It provides better user experience, access to more updated information, and brings transparency to business conducted on mobile devices.

Fintech also makes it possible to provide financial products to people without bank accounts.

Faster Access to Loans:

Businesses and individuals can get same-day loans for their needs which is possible only through Fintech. Various online lenders provide prompt assistance and enable customization of banking products and services.

Streamlined financial operations:

Even though finance is an essential part of the business it is often mismanaged. Fintech’s one of the strongest features is its ability to streamline various financial processes.

Finance management and budget management apps make it easier for businesses to easily manage various activities such as tax filing, bookkeeping, money transactions, receive updates and can provide a wide degree of access to financial products where accounts are assigned with limited privileges.

Improved Customer Experience:

Fintech can be adopted cost-effectively while providing a superior customer experience. While better speed and convenience can improve customer retention such as by using Big Data and AI to provide a more personal and more customized experience.

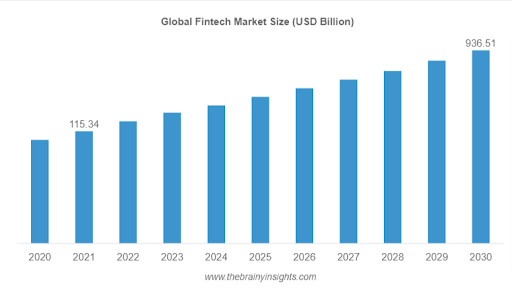

Fintech Market Overview:

Top Fintech Market Trends and Stats

- Fintech assets grew by more than 100% from 2013 to 2022. Where as traditional bank assets grew by only 75%

- In 2021 Fintech companies acquired $210 billion in global investment

- In October 2022 there were over 300 unicorn fintech companies worldwide

- In 2022 the global transaction value of digital payments reached over $8 trillion

- Insurance fintech companies raised about $15 billion in investment in 2021

These trends suggest that fintech is one of the most trending technologies in 2023; moreover with the advent of technologies such as AI and ML it can truly reduce the chances of fraud making way for greater financial inclusivity.

Here is others reasons of fintech application for being the role model for any industries

How Fintech Works?

There are various types of fintech apps which work in various different ways. It enables safe access of financial account data such as account balance and transactions using apps that enhance or enrich the data.

Wealth and financial management apps aggregate the financial account data from different accounts into one easy to view format. It conveniently provides all related financial information in a single platform.

Are you looking for a Fintech developer

Another way fintech apps work is by funding the new accounts for existing bank accounts, Then use those funds to carry out activities such as trade stocks, cryptocurrencies, and more funds from their bank accounts into separate accounts.

APIs:

Financial APIs safely connect consumer’s bank accounts to this apps and services so that they can share their financial data, transfer funds and verify their identities.

Mobile Apps:

Fintech companies also develop mobile apps that users can use to access funds and insights at any time. It could be a digital banking app, a financial management tool, or an investment platform.

Web-based solutions:

On top of providing mobile apps, some fintech companies also provide web-based solutions where users can log-in through web browsers and access the same functionality they perform on mobile apps.

Types of Fintech

The Top 4 Categories of Fintech Users:

- B2B bankers

- Business clients

- B2C businesses

- Consumers

Top Technologies Used for Fintech Applications

Fintech companies use a variety of technologies such as AI, Big Data, Blockchain and Robotic Process Automation.

- Artificial Intelligence can take your spending habits and expenses to create insights and help you forecast your future spending by factoring in your expense pattern and market economy.

- Big data can forcast an investment plan for you by using data generated from millions of users as well as by understanding the existing market economy.

- Robotic Process Automation is an AI technology that focuses on automating various repetitive tasks.

- Blockchain using a digital ledger to keep your finances and financial data secure while you make transactions.

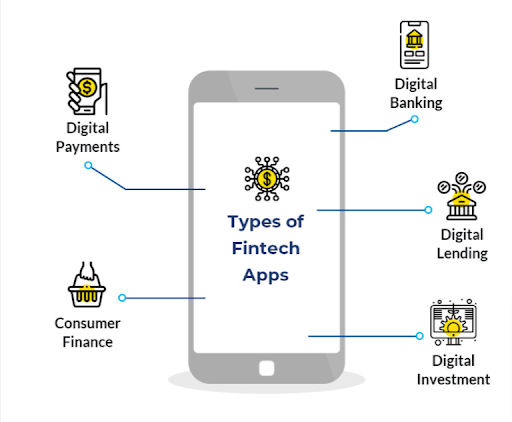

What are the Different Types of Fintech Apps?

(Image source: https://www.indusnet.co.in/)

- Lending Apps

- Payments App

- Personal Finance Tracking

- Equity Finance App

- Consumer Banking App

- Insurance Apps

How Fintech Influences The Financial Market?

- Fintech empowers consumers by democratising access to financial services especially in the developing countries. This encourages other financial services to innovate.

- Improve new service opportunities, new strategies and channel commercialization.

- Improve efficiency in back-office management and frontline procedures in traditional financial institutions.

- Creation of new investment opportunities

- Improve financial supervision

- Improve and optimise risk management process

- Prevalence of technology know-how among the general population

What is the Impact of Fintech on Banking Industry

- Cloud technologies and Big Data enables faster access of data without the need of installing specialised applications on devices.

- This enables fintech companies to provide personalized offers based on the analysis of fast-moving digital information.

- Application programming interfaces can be integrated into the systems for interaction with clients.

- Social media and mobile communication have special applications, this integration of the banking business enables them to collect information about customer preferences for the purpose of using it when proposing new financial products, and establish trust relationships with each bank’s client.

- The primary advantage of omnichannel banking is that customer’s troubles can be resolved faster. Using the internet and mobile devices both bankers and consumers can avoid in-person interactions in bank branches to get to their point quickly and efficiently.

- Payment systems are adjusted with tools and AI that can predict their activity in the future and suggest payment methods with reduced fees.

Conclusion

Despite being a complex system, fintech presents significant opportunities for financial services, startups, and the corresponding infrastructure.

The service sector increasingly uses new technologies and tools to influence and improve such as insurance, lending, accounting, asset management, investment, tax administration etc.

Today, many startups are opting for fintech app development to create more convenient and revolutionary solutions to help improve the financial scenarios of their nation.

Fintech is one of the most lucrative sectors attracting tons of business owners to build mobile fintech solutions.

FAQs

- How can Fintech development benefit my financial business or startup?

Fintech development benefits financial businesses and startups by enabling innovative and user-friendly solutions, streamlining operations, automating processes, enhancing security, and providing personalized financial services. It boosts customer engagement and loyalty, leading to increased competitiveness and growth.

- How do Fintech developers ensure compliance with financial regulations and data protection laws?

Fintech developers ensure compliance with financial regulations and data protection laws through rigorous testing, encryption, secure data storage, and adherence to industry standards. They implement robust security measures and maintain regular audits to safeguard sensitive financial information.

- How can Fintech development improve customer experiences in the financial industry?

Fintech development enhances customer experiences by offering convenient, fast, and accessible financial services. It enables features like real-time transactions, personalized recommendations, seamless mobile banking, and easy account management, fostering greater user satisfaction and loyalty.

- Can Fintech development assist traditional financial institutions in their digital transformation efforts?

Yes, Fintech development can assist traditional financial institutions in their digital transformation efforts. It helps them integrate digital technologies, automate processes, enhance customer interactions, and stay competitive in the rapidly evolving financial landscape.

- What is the typical cost and timeline for Fintech development projects?

The cost and timeline for Fintech development projects vary based on complexity and scope. Smaller projects may range from a few thousand dollars and a few weeks, while more extensive and intricate projects can cost several hundred thousand dollars and take several months to complete.