Mobile Banking is gaining popularity at a substantial rate. Technology is shifting to a notch higher every single day and it’s required to be in-sync with it at all times. E-commerce, Products, e-Wallets and even Banks are offering services through mobile now.

For today, let us talk about mobile services provided by your own bank;

YOU TRANSACT, MAKE PURCHASES, MANAGE ACCOUNT & almost everything.

But, the most important question – HOW SECURE IS YOUR MOBILE BANKING SERVICE !

Well, in this article, I will tell you about the pros, cons and some very important tips to keep in mind while playing with your bank application through mobile.

“The mobile industry is very dynamic; we make sure we’re up-to-date.”

Dottie Yates

Senior Vice President of the e-platforms team. (Bank of America)

(Source: bankrate.com)

In a financial year, more than 53% smart phone user stake the help of mobile banking services to manage their daily banking chores.

Near about 35% users are from USA – that’s a big chunk

Some more statistics to let you know the present situation of “Mobile Banking Services”

According to 2015 survey in USA: mobile banking is used by 62.1% people – those who earned less than $25,000 and used by 45.6 % earning in between $40,000 to $74,999.

Contents

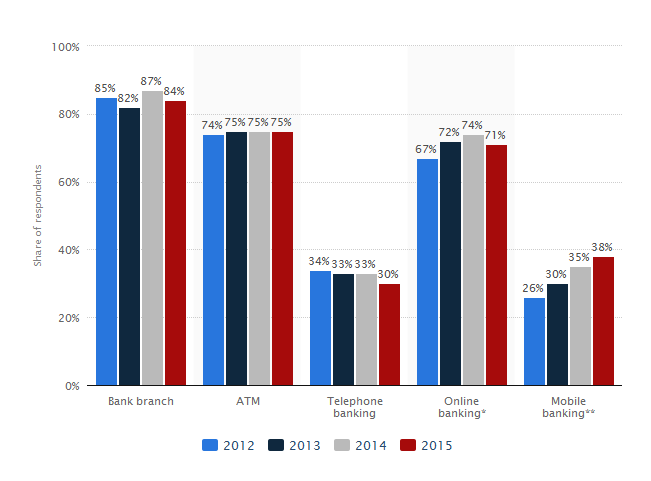

Different Medias to access banking services in USA

(Source: statista.com)

On “cbsnews.com”, US Federal Reserve survey has stated that:

87% of U.S. adults have mobile phones; out of them 71% are Internet-enabled with the possibility of 10% increase in the use of mobile phones.

More than 39% adults are using mobile banking and possibility of 33% increase in the uses of 2013.

Banks are taking quick actions to provide user-friendly and highly secured mobile banking with the help of mobile apps. They are taking it very seriously and are into the process of Augmented Mobile Application Development – to make sure banking services are highly protected.

Mobile banking has become a standard, but still it has certain pros and cons. Prior to using it, people must be aware about mobile banking and its security. Let me explain in detail;

Pros of Mobile Banking

No more standing in long ques for transferring money for your parents living across the state or renewing you cheque book. Gone are the days of pain that people used to go through earlier. Nowadays, even my Grandma uses her iPhone to transfer money to her sister living in Texas. Things have got pretty easier.

Banking and financial sectors are developing secure and user-friendly mobile apps for different types of smart phone operating systems.

The most important benefits of mobile banking

- Facility of account access and management with all the information in your palm

- Any payment, transaction and transfer made easy

- Save time with error free transaction

- Easy to use

- You are able to see – all your historical transactions (to understand how your spending was and where exactly you did)

Cons of Mobile Banking

Besides all the advantages (which we agree!) – Security is a major hitch.

With the increase of technology – there are groups of hackers and phishers who make sure your bank account is compromised. Cyber theft – is a potential concern and a mobile transaction is a target the hackers set first in their priority list.

Let us have a look at the drawbacks on where mobile banking needs some improvements.

- Improvisation on transaction security

- Reduction of transaction issue.

- Fixing of account access and balance access issues

- Better user interface and user experience issues

Secure and Safe Mobile Banking Tips:

According to the above statistics, without any doubt mobile banking will make user’s daily life easier and smarter. However, it is always better to stay alert and protected. Have a look on some of the attentive tips for a safe and secure mobile banking experience

- Set and use passwords to unlock your device (no matter what do see that no-one is peeping at your mobile screen)

- Do not allow banking app to remember your password (Keep in your brains – that’s where it’s the safest with neurons guarding it)

- Do not save account numbers, PINs or passwords on your banking app (or any other such apps as these apps use cloud servers to save the data, which is again a high-risk)

- Download your bank’s app from genuine source (not from any third party packages, links or websites)

- Immediately report to your bank to lock your account and all related cards if you mobile phone is lost or stolen (Till you have all the previous accounts, cards and passwords updated)

Mobile banking is an essential part of our day-to-day banking transactions but keeping it secure and taking notes of not letting anyone take unruly advantage of your account is crucial in order to protect your personal and financial information.

You can also check security tips of iOS and Android phone in my previous articles.

At Andolasoft we make sure, each and every application we build – are security rich minus the security compromises.